For those asking, what did the software say and the IRS regarding being red flagged when I went to file my taxes online.... Not able to e-file and had to mail my taxes in to the IRS.

This are facts.

***

I had no knowledge of anyone claiming me, under their taxes; 2023.

No one, contacted me discussing ANY possibility of claiming me, on their taxes, 2023.

No one, had purchased any vehicle for me in 2023.

Meaning...

I am not, on any purchased vehicle title or deed, and nor was gifted any vehicle in 2023.

No one, lived with me as a caregiver or medical aid attendant in 2023.

***

These are just some, of the questions, that the IRS legal department asked of me yesterday.

Unnecessary stress and unnecessary trouble making. Made it to where, I had to cancel an importance scan and instead, spend an entire day with the IRS. I was even asked, to contact 3 of 4 individuals in question.

One got very angry, right from jump!

I am, in complete disbelief and beyond, disappointment.

Four individuals, that I know of are the only ones, who would have had access to my social security number. My personal identity.

Cross out 1 now, of the 4. Now Eric was flagged because, we need to file 2023, together on our taxes. We cannot do so now because, I was already claimed, without my knowledge on someone else's taxes. He didn't do it, per IRS, because he hadn't finished filing. He can't now.

***

Per legal department, with the IRS;

*You are to never claim anyone and use their social security number, without their permission and communicating this first with anyone's personal identification number.

*You're never to use someone's, personal identity and social security number for tax benefits or tax write-offs without permission... at least letting the person know well in advance. Explain why an individual or individuals feel they have a right to claim you as their dependent. Using your personal identification number.

Now, this has also affected Eric's taxes... as if this morning, they were rejected. The tax breaks, that I was entitled to, disability, cannot be honored on my end... because I was already claimed as a dependent on someone else's taxes.

This means, I cannot do anything with my taxes now, because somebody already used me and my social security number, to claim me as a dependent.

There are reasons, that myself and Eric have to file our taxes together now, 2023. Because I was claimed already, without my knowledge. I cannot do so.

He was also flagged and has to send all of his tax information by mail and required to fill out additional IRS tax forms.

This is ALL unnecessary, and ALL unnecessary stress, that noone should place, on anyone.

***

I am extremely disheartened.

I am completely in disbelief.

Facts are facts.

***

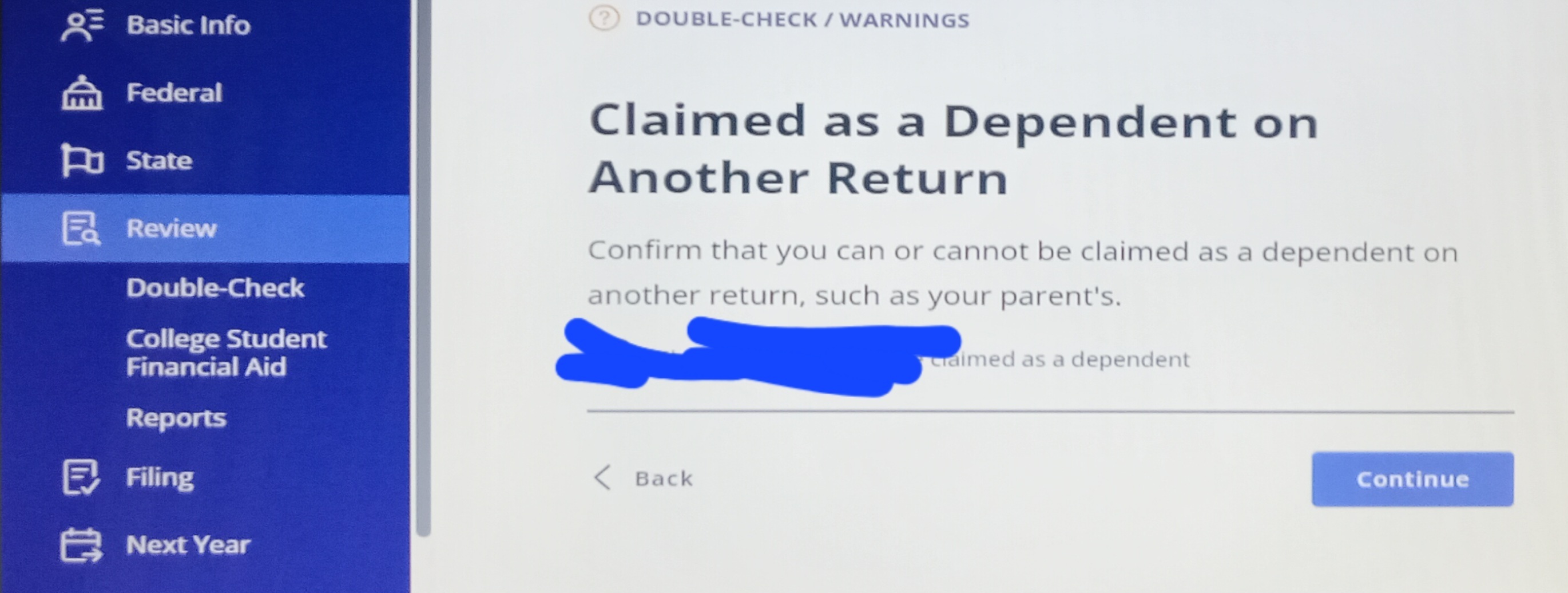

This is a screenshot, for those asking, regarding my taxes and not being able to file properly this year, because someone used my social security number without my permission or even without my knowledge and claimed me as a dependent.

***

Free Yourself...My Journey

freeyourselfmyjourney@yahoo.com

Comments (0)

To leave or reply to comments, please download free Podbean or

No Comments

To leave or reply to comments,

please download free Podbean App.